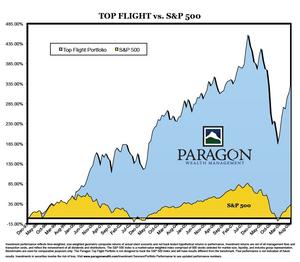

Top Flight, Paragon Wealth Management's growth portfolio, has continued to surpass the S&P 500 for almost 12 years.

Top Flight, Paragon Wealth Management's growth portfolio, has continued to surpass the S&P 500 for almost 12 years.

"Active wealth management has increased our returns, reduced risk and proven itself in our performance numbers," said Dave Young, President of Paragon

"Active wealth management has increased our returns, reduced risk and proven itself in our performance numbers," said Dave Young, President of Paragon