The 100-year-old JB Duarte, has chosen a new path for its business. The company has decided to focus on the real-estate market in the countryside of São Paulo, and it expects to launch projects with potential sales of R$100 million over the next four years. US investment fund Golden Eagle, which works with construction and real-estate development, is considering investing in the Brazilian company.

The 100-year-old JB Duarte, has chosen a new path for its business. The company has decided to focus on the real-estate market in the countryside of São Paulo, and it expects to launch projects with potential sales of R$100 million over the next four years. US investment fund Golden Eagle, which works with construction and real-estate development, is considering investing in the Brazilian company.

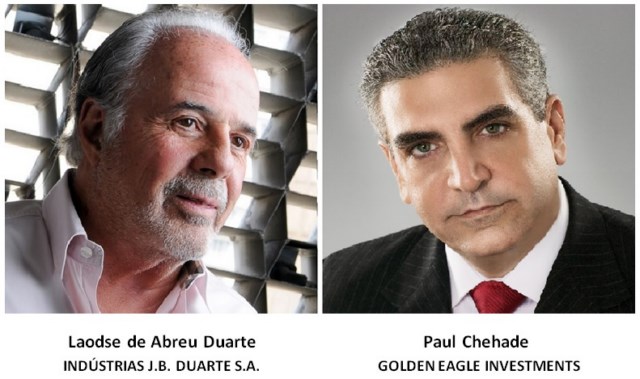

Golden Eagle Investments - Ethical junction making choices easy - Paul Chehade:.

Golden Eagle Investments - Ethical junction making choices easy - Paul Chehade:.